Cartels are groups of organizations that collude with each other to drive up prices, crush competition, and ultimately extort huge amounts of money to redistribute to the cartel members. While the word is often associated with drugs, oil-producing countries, or anti-competitive business practices, politicians from nine blue states are attempting something new in the U.S.—a tax cartel.

State legislators from California, Connecticut, Hawaii, Illinois, Maryland, Minnesota, New York, Oregon, and Washington announced a coordinated set of bills to hike taxes on wealthy individuals, families, and businesses. The purpose of coordinating is to try to keep these taxpayers in their respective states by making it seem like crushing taxes are inevitable wherever they move.

But this desperate attempt to defy the laws of economics—whereby if you tax something, you get less of it—is doomed to fail.

Blue state politicians have an insatiable appetite for more tax revenues so that they can create big-government programs that serve as selling points in their election campaigns. But while politicians want to dole out programs and money to everyone and their brother, they want the average voter to believe that somebody else can pay for all these programs. So, they go after the big dogs—the millionaires and billionaires.

California Assembly Bill 259, for example, would impose a 1% tax on those with a net worth of $50 million or more and a 1.5% tax on residents with a net worth of $1 billion or more. Unlike income taxes—which in theory only apply to new income earned in the past year—wealth taxes like this would tax the same dollars year after year.

When combined with federal income taxes, net investment income taxes, state income taxes that are the highest in the nation, property taxes, and the like, some California taxpayers would face an effective income tax rate of more than 100%.

New York Senate Bill 1570 would apply an 8.2% billionaires’ tax to unrealized capital gains on the value of stocks, closely held businesses, and other investments—often based on subjective assessments of year-to-year increases in asset values.

The other seven states’ bills differ on the details but are aligned in trying to stick more of the tax burden on the rich.

Rolling out these taxes as a coordinated effort instead of in isolation is an attempt to avoid an exodus of wealthy individuals from high-tax states. The highly publicized moves of billionaires leaving for lower-tax states—like hedge fund CEO Ken Griffin moving his Citadel headquarters from Illinois to Florida, Elon Musk moving Tesla’s headquarters from California to Texas, and investor Carl Icahn moving from New York to Florida—are just a few examples of what blue state lawmakers want to avoid.

Becoming a cartel requires having control over enough of a market to take down the competition, at which point cartels can restrict output, control prices, and reap huge profits.

That’s what this group of blue state politicians erroneously seems to think it can achieve, as Illinois state Rep. Will Guzzardi, a Democrat, explained: “That’s part of why we are working as a multistate coalition. We want to send a message that there is nowhere to hide.”

But taxpayers can still legally “hide” their wealth in certain assets like out-of-state real estate and tangible property.

And if they don’t want to hide their assets by purchasing things that are harder for politicians to tax, there are still plenty of places for them to run, much to the chagrin of these blue-state lawmakers. Wealthy individuals can escape high-tax regimes by moving to low-tax states that will welcome them with open arms. Indeed, high-income tax states are already hemorrhaging their populations.

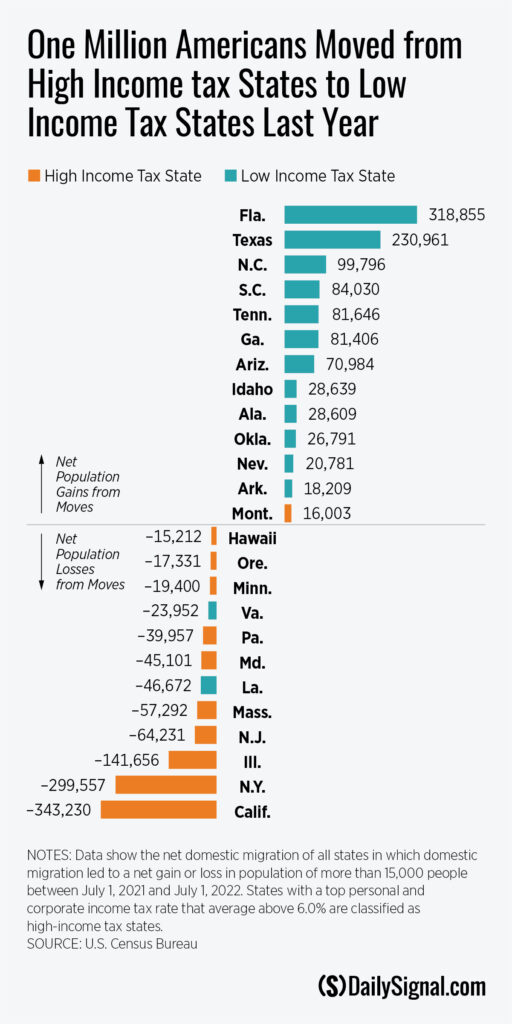

Twenty-two states and the District of Columbia have top personal and corporate income tax rates that average above 6%.

Census data shows that last year there was a net outflow of more than 1 million residents from these high-income tax states and Washington to the other 28 states. This dramatic trend of migration into low-tax states isn’t new, though it’s accelerated in recent years.

The fact that middle-income Americans are also fleeing from high-income tax states demonstrates that when state lawmakers try to soak the rich with high taxes, everybody ultimately gets drenched.

These new taxes aimed directly at the rich would put more of the wealthiest taxpayers in the front of the exodus. And when the people who pay the most in taxes leave, that means big tax hikes on everyone who’s left.

Wealth taxes, especially, are incredibly ineffective at raising revenues. A dozen countries in Europe had wealth taxes in 1990, and all but three abandoned them either because the administrative costs were prohibitive or because the taxes were driving wealth and jobs out of their countries.

Of the three countries that kept their wealth tax, Spain’s and Norway’s are largely ineffective, accounting for only 0.5% and 1.2% of the countries’ respective total tax revenues. And those wealth taxes apply to households that accumulate only a modest amount of wealth over their lifetimes. Norway’s tax begins at only $170,000 of net taxable wealth.

Switzerland’s wealth tax generates more revenue—about 4.9% of its tax revenues—but that’s because it applies to almost all housing, working effectively like a property tax so nearly everyone—certainly not just the rich—pays the tax directly or indirectly through higher rents and mortgage payments.

This all goes to show an uncomfortable reality for blue-state lawmakers: Massive government spending schemes funded by piling the tax burden onto a tiny number of wealthy taxpayers will ultimately collapse under their own weight.

The states that attract new residents take a very different approach of using broad-based sales taxes to pay for necessary—but more limited—government spending.

And because workers and employers prefer to keep more of what they earn and like having the economic freedom to decide for themselves how to spend their own money instead of having to jump through bureaucratic hoops to see what government programs can provide for them, Americans keep moving to these states in droves.