President Joe Biden’s latest budget proposes the federal government spend trillions more than it will take in, increasing the already unsustainable federal debt by $17 trillion over the next 10 years.

But these 13- and 14-figure dollar amounts have little meaning for ordinary Americans whose income, spending, and debt are typically in the five- and six-figure amounts. Translating Biden’s budget down to the household level provides a better perspective—albeit a grim one.

His proposal has the government spending $7.3 trillion in 2025, rising to $10.3 trillion in 2034, with the federal debt climbing from $37 trillion to $54 trillion, even after accounting for $1.4 trillion in tax increases on the “wealthy Americans and big corporations.”

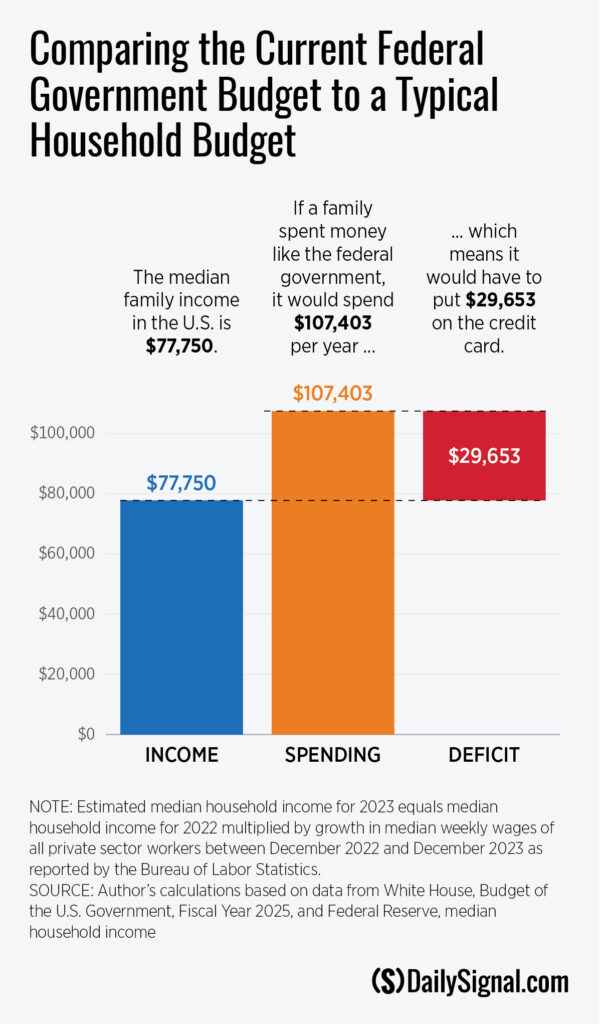

To break this down to the household level, we begin by looking at the median household income, which was an estimated $77,750 in 2023. (Note: The author’s estimate is based on 2022 median household income, increased by median earnings growth in 2023). If the median household budgeted like the federal government, they would have spent over $107,000 in 2023 and taken on nearly $30,000 in new debt, increasing their total debt to about $579,000.

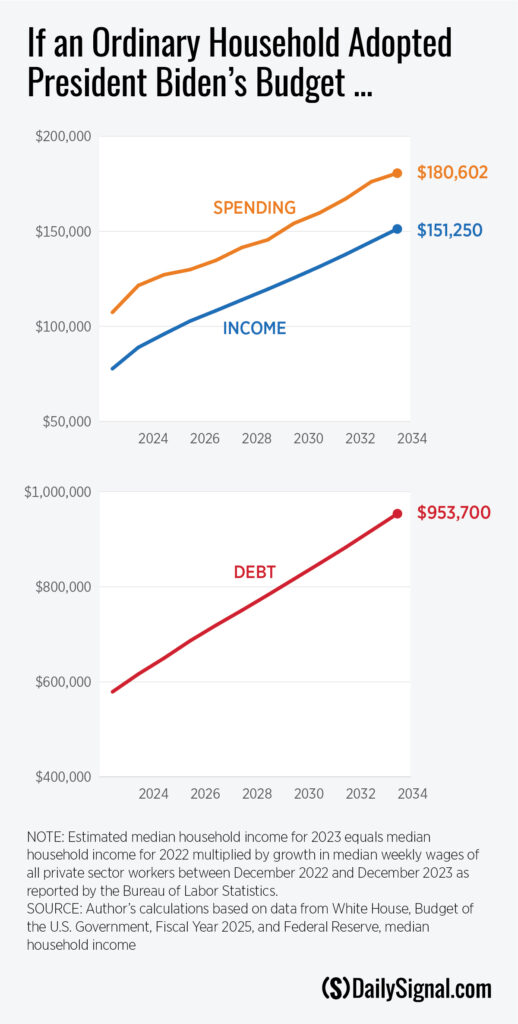

Under the new Biden budget, if household spending and debt grew at the same rate as the federal government’s spending and debt, the average household would spend $348,000 more than it earns over the next 10 years, and total household debt would rise to $954,000. With the median home price equaling $417,700, that debt is equivalent to having 2.5 mortgages.

But the trajectory of this bleak and unsustainable family budget could actually turn out far worse. The president’s budget assumes that tax revenues will increase 70% over the coming decade. For the median household, that would mean a big jump from the current $77,750 annual household income to $151,000 by 2034. Yet over the past three decades, household incomes have averaged half that growth, at 35%. If household incomes were to rise less than projected, household debt would climb even higher. That same calculus applies to the federal government.

While the federal government has a greater ability than households to increase its income in the short run—because Congress can pass laws to take more money from taxpayers—higher taxes lead to a smaller economy, which ultimately makes maintaining higher government revenues even more difficult and damaging to ordinary Americans’ incomes and well-being.

It’s important to note that Biden’s budget does nothing to address the depletion of Social Security’s trust fund, which will result in 23% in benefit cuts—a loss of $5,300 for an average retiree—for all Social Security recipients beginning in 2033. Translated to the typical household budget, that’s like draining all retirement savings accounts on top of accumulating $348,000 in new debt, while relying on one’s children to provide for oneself in retirement.

Without including any specific Social Security proposals, Biden’s budget messaging says that he is committed to working with Congress to protect and strengthen Social Security by asking the highest-income Americans to “pay their fair share.”

The problem with that “commitment” is that the one Social Security proposal that was designed to align with Biden’s promises—the Social Security 2100: A Sacred Trust Act—relies on budget gimmicks, including 75 years of tax increases but only 10 years of benefit increases. If the benefit increases in that proposal were made permanent, it would actually hasten Social Security’s insolvency by two years and increase its shortfalls by 21%.

The only current proposal that would make Social Security solvent (at least before accounting for the negative economic impacts) would expand the program and hike taxes by $34 trillion over the next 75 years. That plan—the Social Security Expansion Act—includes a new 16.2% tax on small business owners and top federal tax rates of 51.8% on wages and 36.2% on long-term capital gains and dividends, up from the current 40.2% and 23.8%, respectively.

Combined with state taxes, the top rates would equal 65.6% on wages and 51% on long-term capital gains and dividends. And those tax rates don’t include the tax hikes on the wealthy and high earners that Biden proposed in his budget.

Simply put, it is impossible to pay for current spending—and even less so, Biden’s proposed spending increases—by taxing the rich.

If the president—or any lawmaker—wants to relate to and help ordinary Americans, he should start by adhering to the same budget limitations faced by ordinary Americans. No responsible individual or family would consistently spend more than they earn, nor would they spend money in ways that prioritize their own consumption over the future well-being of their children and grandchildren.

A responsible federal budget would address the major drivers of our federal debt by proposing commonsense reforms to major entitlements like Social Security and Medicare, and by reorienting federal spending to only inherently federal government purposes. And just like a responsible household budget helps families pursue their goals, a responsible federal budget would help expand opportunities and increase the well-being of younger and future generations.

Reprinted with permission from The Daily Signal by Rachel Greszler.

That the public just continues to sit by as the federal budget has gone from $4.5 trillion in 2019 under Trump to now a proposed $7.3 trillion for 2025 under Biden, a nearly 50 percent increase and people wonder why inflation has skyrocketed in the last few years, is the real story.

Governments, especially socialist or pure Marxist models, tend to consume as much as they can take from the private sector to expand their reach and increase their power. That this explosion in federal spending, when the so-called Covid emergency is long passed, will be met by a collective shrug and little else from the public will only encourage the Democrats to continue their wild tax and spending spree. If anyone still thinks inflation will return to under 2 percent, prices will revert to what they were just 3 1/2 years ago or no one making under $400,000 a year will see a substantial tax increase, then I have a lovely bridge in Brooklyn to sell you. No leftist government has ever voluntarily backed off their agenda without being forced to. That is just reality as shown throughout the last couple of hundred years of modern history.

We are well on our way to losing our global reserve currency status in the next few years, which will result in us seeing rates of inflation similar to what countries in South America and elsewhere around the world consider the “normal” annual rate of inflation.

If my family spent money the way the federal government spends money, we would have BANKRUPT decades ago. Also, the federal government is in denial over the fact that they have a SPENDING problem not a revenue problem Even if the government takes 100 percent (NOT a suggestion) of every penny earned by millionaires, billionaires and big corporations, it will do nothing about the deficit if they don’t CUT SPENDING!

Unfortunately, this is all by design to destroy the country. Elections have consequences.

Excellent article. Dictator Beijing biden keeps raising taxes to make Bigger Government with More Unaccountable Bureaucrats including giving Federal Employees another 2% Pay Raise after how many raises since in office while his INFLATION KEEPS GOING UP and our Income gets SMALLER and SMALLER with Less and Less FOOD and MEDICINE at Outrageous Continuous Price Increases. Not to forget his killing of our ENERGY INDEPENDENCE under President Trump.

Just like I have been saying for a long time..INTENTIONAL DESTRUCTION of the UNITED STATES.

WAKE UP AMERICA. The Clock is ticking. Will you keep your Country and live Free? Or will you bow down to the Communist democrats and be SLAVES to a One Party Government?

This is an excellent reason why I am voting for President Trump.

FREEDOM.

” Bidenonomics ” ? I wouldn’t trust that ungodly low life, fake Catholic with a sidewalk lemonade stand. The crooked jerk.

That sure puts it in perspective. I don’t think anyone in this administration understands economics or budgeting.

Under the new Biden budget, if household spending and debt grew at the same rate as the federal government’s spending and debt, the average household would spend $348,000?? Do you see something wrong with this?? If NOT go back to watching msnbc and cnn.

The Democrats are doing to us what a criminal would without any consequences for it. We as a normal citizen would be in jail if we did what they do… In fact, they’re trying to get Trump in jail for doing far less… So, I have no clue what the solution would be but to ban all of them from public office and split the Republicans into two parties and start all over again… And declare bankruptcy…

Most of our politicians can’t even balance their own check books.

Politicians, both parties, have been following this type budgeting and spending for decades. Creating a Federal Deficit that threatens our national security and the future of our Republic. This further proves our need for constitutional amendments that specify term limits for Senators and Representatives, and force Congress to develop a balanced budget. Just my 2 cents…

I am completely amazed how stupid this Obiden administration is talk about no commen since , it seems to me Obiden and his administration are traitors of the American people, and has been getting away with this out of control spending , it seems their main goal is to destroy this country, you have human an child trafficking , along with drugs from China coming across the boarder you can’t tell me this corrupt administration isn’t making money off of this mess . I never thought I would see the day where traitors from the inside would completely get away with destroying this country and nothing gets done about this mess .This is all in God’s hands .

The ONLY ANDWER IS REVOLUTION!!’ Either peaceful or VIOLENT!!! Let those who THINK they are in charge make the choice! RESIGN or suffer the consequences!

I don’t understand the problem. If I print all the play money I need to cover expenses why wouldn’t I be able to pay the bills? Oh, that’s right. That would be illegal. For ME. Now I see the problem.

The “Democrats” (what irony in that name!) are pushing us towards adherence to U.N. Agenda 21, which is intended to become the means by which we all would be forced out of our cars and our single-family homes.

The intention is to put everyone but the “New Aristocracy” into high-density urban population centers that would not permit keeping or using private automobiles, and would only accommodate public transportation.

UN Agenda 21 is a real thing. Google it and read about it. It’s as dark a future as President Johnson’s urban housing projects from the 1970’s… but for all of us…

We’re all wasting time batting our gums on this issue. NOTHING is going to change unless we replace the politicians that do this to us. But we won’t because people may hate congress, but they love their congressman. Then I hope you love being in debt.

Lets all vote Republican in November in all level of the elections. Lets say Goodbye to Democratics!

certainly like your website but you need to take a look at the spelling on quite a few of your posts Many of them are rife with spelling problems and I find it very troublesome to inform the reality nevertheless I will definitely come back again

However, the wealthy actually pay 42+% of all taxes even if they have legal deductions that they can take when filing. I’m not happy with what the government is doing and I know your average citizen making far less than $400,000 per year is going to have their tax rate increase too. We all should know by now the the Democrats are the tax and spend party and always have been.

The fact that America can be destroyed on every front is almost more than I can comprehend. And we have no means to stop it? Nothing? Only GOD. ????????????????

People elect politicians expecting them to govern as promised. When these politicians go off plan to dictate policies that serve themselves and cronies we suffer. Complaining gets virtually no results. Electing someone else in the next cycle seems to produce different but essentially the usual corruption.

We might have a chance with Convention of States to work for meaningful Constitutional Amendments such as term limits and balanced budget. Opportunities are dim when the politicians work harder at corrupting the election process than they work for those who elected them.

Please excuse the long length of this comment … There is a possible way to resolve 2 major issues facing our country today. Simply put, it would involve issuing, for those who cross into the U.S. without consideration of our law (a.k.a. illegal aliens), a “purple” card rather than a green card. Everyone who holds a purple card would be subject to a lifelong penalty (just as is currently applied to those who do not sign for Medicare as promptly as Uncle Sam would like). The funds received from the penalties would be used to bolster the Social Security coffers. … less enticing handouts to the illegals AND a few extra years of stability for those of us who paid into the system for 50 or more years.

That would certainly help. Legally, they can take advantage of loopholes and hire lawyers and accounts to do that. Maybe congress wants loopholes so they can take advantage also.